SFDR Reporting Software

Effortless monitoring and accurate statements.

Save time and resources reporting on SFDR.

What is the SFDR?

The Sustainable Finance Disclosure Regulation (SFDR) is part of the EU’s Sustainable Finance Action Plan. It requires financial market participants-including asset managers, investment firms, pension funds, and insurance companies-to disclose how they integrate sustainability risks and consider the impacts of their investments.

On this page, you can expect an overview of the SFDR regulation, the main disclosure requirements, and how SFDR software can support compliance effectively.

What is the scope of SFDR?

Companies in scope:

SFDR applies to a range of financial institutions operating in the EU or marketing products into the EU, including:

-

Asset managers and fund managers

-

Banks and credit institutions

-

Pension funds and insurance companies

-

Venture capital and private equity funds

-

Financial advisors and institutional investors

Both EU-based and non-EU firms marketing financial products in the EU are covered by SFDR.

Key disclosure elements:

SFDR requires two main types of disclosures:

-

Entity-level disclosures: How sustainability risks are integrated into investment decisions and how those decisions affect environmental and social factors.

-

Product-level disclosures: The sustainability characteristics or objectives of specific financial products, including classification under Article 6, 8, or 9 (from non-ESG to sustainable products).

Firms must collect, analyze, and report on a range of ESG indicators, covering environmental, social, and governance issues.

How SFDR software helps with compliance

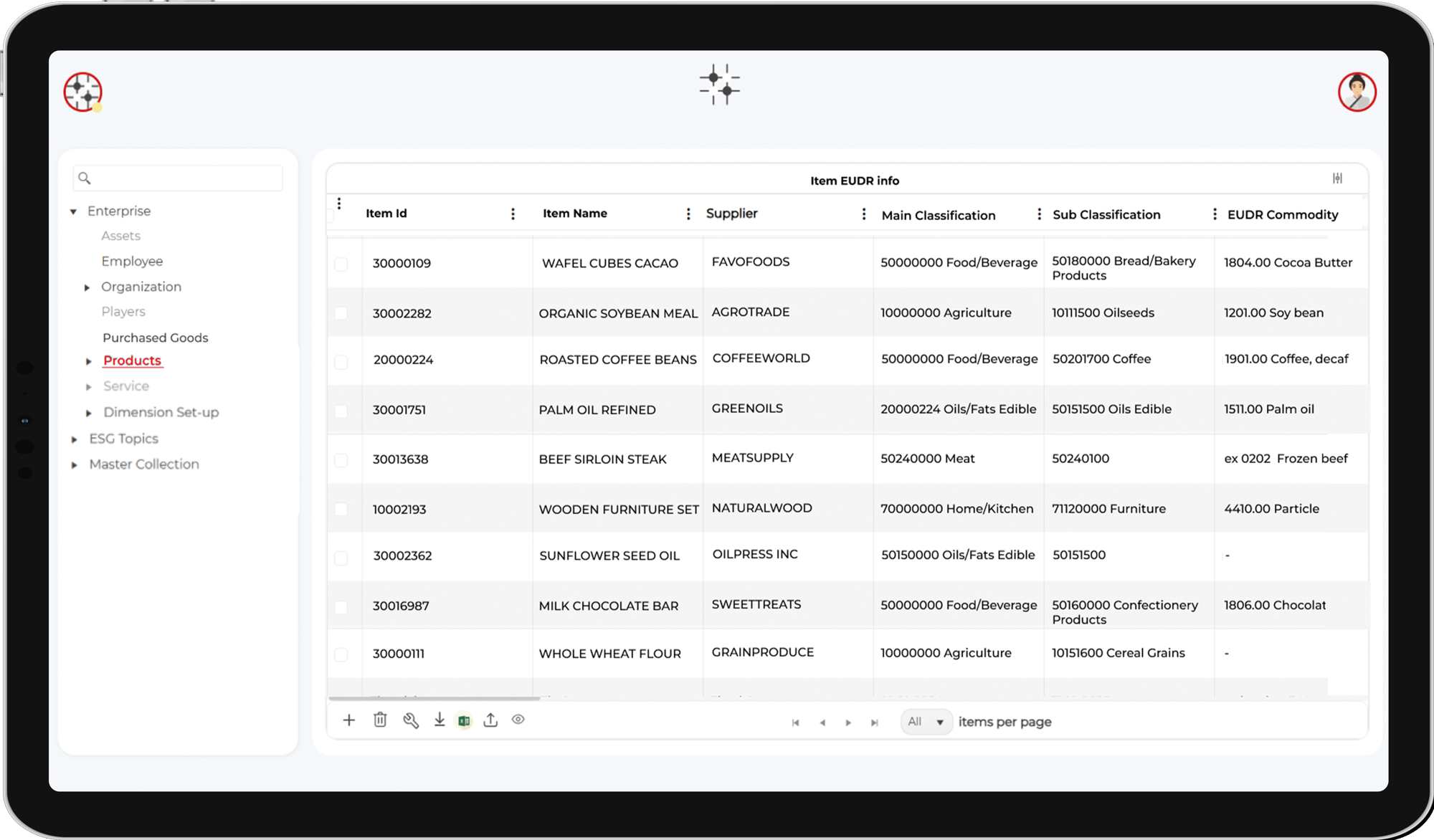

Easy data collection

Helps gather ESG data from portfolio companies, funds, and third parties.

Seamless collaboration

Supports communication and workflow between stakeholders.

Workflow Automation

Guides users through data collection, validation, and reporting.

Easy reporting

Generates disclosures for Articles 6, 8, and 9, ready for publication and submission.

ESG indicator management

Centralizes and standardizes all required data, calculations, and documentation.

Audit trail

Easy to manage record of data and actions for regulatory view.

A digital solution

Discover a digital SFDR Process

Define ESG Data Needs: Identify relevant PAI indicators and data sources.

Collect Data: Use automated tools to gather and validate ESG data from all portfolio entities.

Analyze & Screen: Benchmark and screen portfolios for sustainability risks and opportunities.

Generate Reports: Produce entity- and product-level disclosures for regulatory and investor needs.

Publish & Monitor: Publish disclosures on your website and monitor ongoing compliance.

Join these users in making an impact with MasterSustainability.today

.png?width=400&name=logo%20(15).png)

SFDR Software

Ready to simplify your SFDR compliance?

Discover how our software can help you automate, streamline, and futureproof your SFDR disclosures-so you can focus on delivering sustainable value.