EU Taxonomy

Introduction to the EU Taxonomy

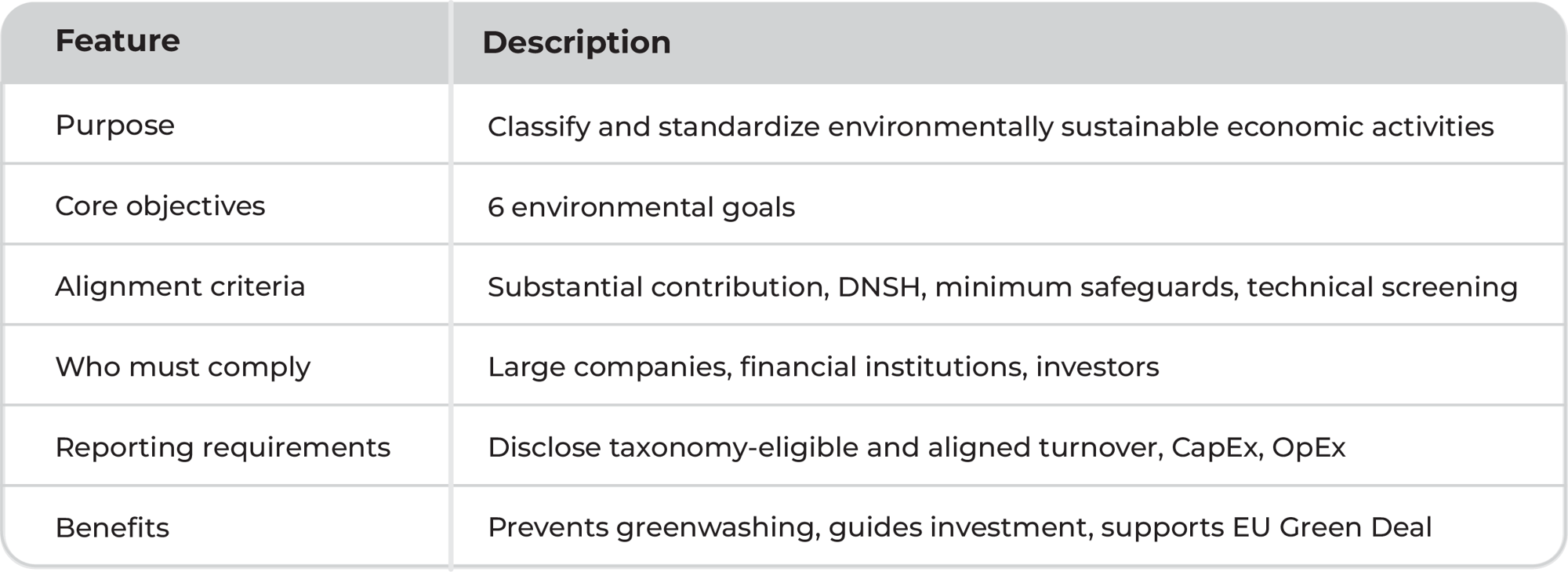

The EU Taxonomy is a cornerstone of the EU’s sustainable finance framework, providing a transparent and evolving system for classifying and reporting on sustainable economic activities.

Its primary purpose is to provide a common language and clear criteria for sustainability, helping direct investments toward projects and activities that support the EU’s climate and energy targets for 2030 and the overarching goal of achieving net zero emissions by 2050.

EU Taxonomy: A clear framework

Before the taxonomy, there was no unified definition of what "green" or "sustainable" meant in the context of business and finance. This lack of clarity led to issues such as greenwashing-where companies exaggerated their environmental credentials-and made it difficult for investors to identify genuinely sustainable opportunities.

The EU Taxonomy gives a clear framework to determine if economic activities are environmental sustainable or not.

This addresses environmental challenges by:

- Creating a transparent and robust framework to determine if economic activities are environmentally sustainable.

- Making it easier for investors to compare sustainable investments across EU member states.

- Supporting the European Green Deal by directing capital flows toward sustainable activities.

Core principles and structure

The taxonomy is in its core a classification system for economic activities. Like a typical classification system, it has rules and definitions. These rules and definitions determine which economic activities can be considered sustainable.

The definition of a sustainable economic activity is based on four criteria. An activity must:

- Contribute to one out of the six environmental objectives

- Do no significant harm (DNSH) to the other five objectives

- Comply with minimum safeguards

- Comply with technical screening criteria

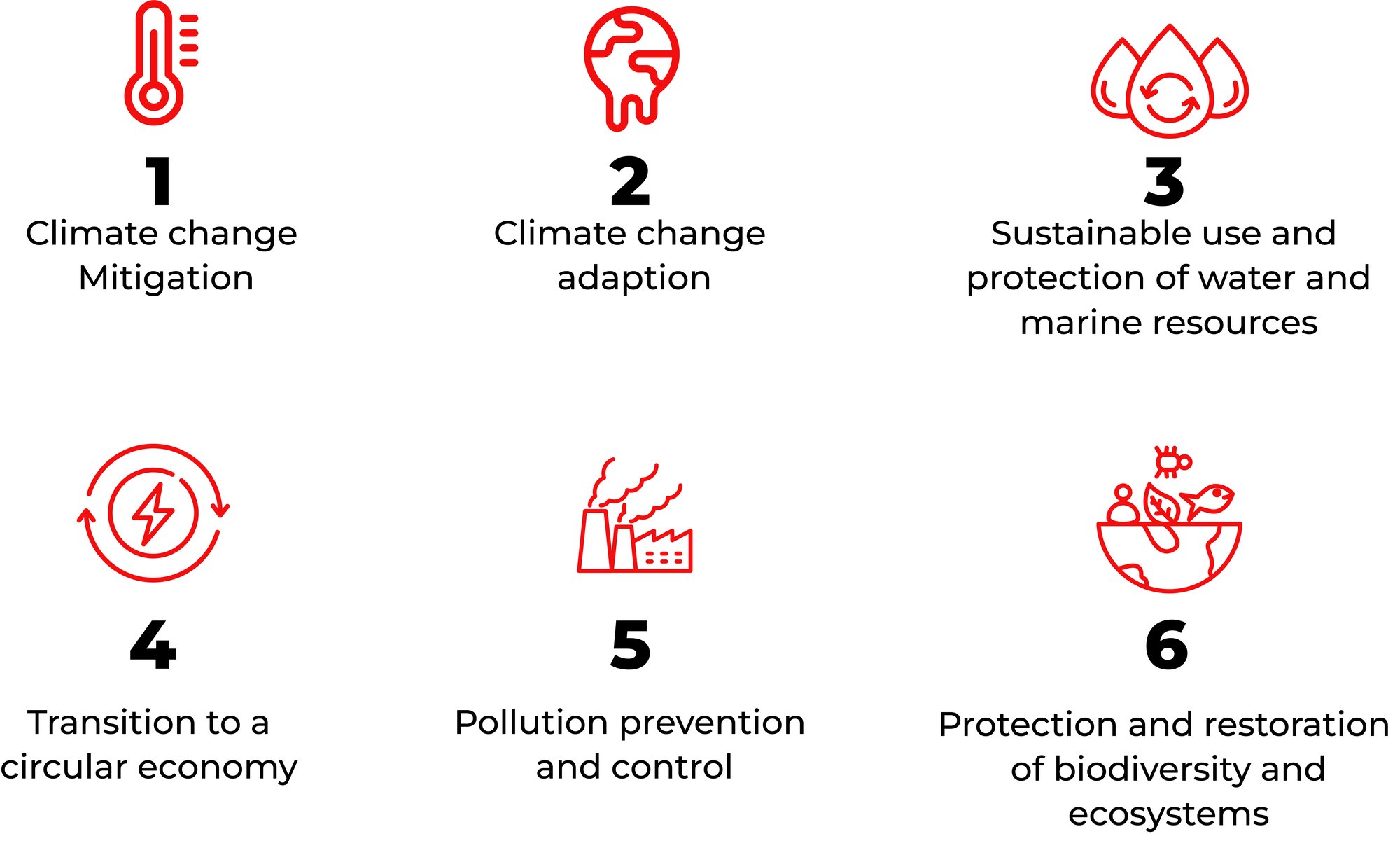

1. The six environmental objectives

To determine if an activity is sustainable, it must contribute to one of the following six environmental objectives:

- Climate change mitigation

- Climate change adaptation

- Sustainable use and protection of water and marine resources

- Transition to a circular economy

- Pollution prevention and control

- Protection and restoration of biodiversity and ecosystems

2. Do no significant harm (DNSH)

The "Do No Significant Harm" (DNSH) rule ensures that any economic activity classified as sustainable under the EU Taxonomy must not cause significant harm to any of the other five environmental objectives.

This means that even if an activity contributes positively to one objective, it cannot undermine progress in areas like water protection, pollution prevention, or biodiversity.

3. Minimum safeguards

To comply with minimum safeguards under the EU Taxonomy, companies must implement due diligence and remedy procedures that align their operations with international standards such as the OECD Guidelines for Multinational Enterprises and the UN Guiding Principles on Business and Human Rights.

This includes ensuring respect for human and labor rights, anti-corruption, and responsible business conduct across their own activities and value chains.

4. Applicable technical screening criteria

To comply with applicable technical screening criteria under the EU Taxonomy, companies must ensure each activity meets the specific requirements set for their sector.

- Identify the relevant criteria for each economic activity.

- Assess whether activities meet the defined thresholds (e.g., emissions limits, resource use).

- Collect and document evidence to demonstrate compliance with all criteria.

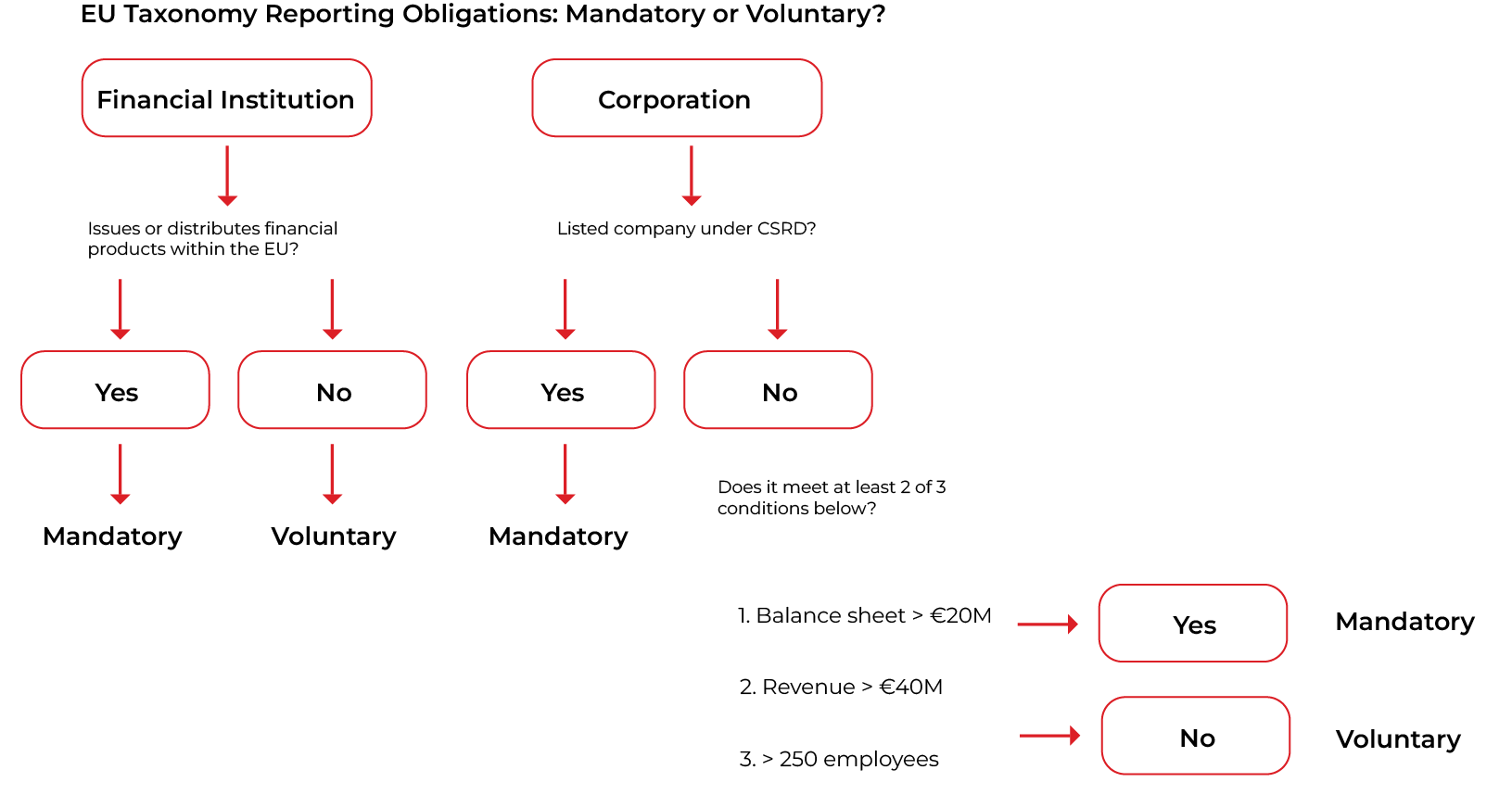

Who needs to comply with the EU Taxonomy regulation?

The taxonomy applies to a wide range of sectors, including agriculture, manufacturing, energy, transport, construction, and more. It is particularly relevant for:

- Large companies and financial institutions operating in the EU, which are required to assess and report the proportion of their activities, turnover, capital expenditures (CapEx), and operational expenditures (OpEx) that are taxonomy-eligible and aligned.

- Investors, who use taxonomy disclosures to make informed decisions about green investments and manage sustainability-related risks.

Reporting and compliance

Reporting under the EU Taxonomy involves two main steps:

-

Eligibility Assessment: Identifying which business activities fall within the scope of the taxonomy, typically using NACE codes (the EU's statistical classification of economic activities).

-

Alignment Assessment: Determining if these activities meet the technical screening criteria, make a substantial contribution to at least one objective, do no significant harm to others, and comply with minimum safeguards.

Companies must publicly disclose the percentage of their turnover, CapEx, and OpEx that is taxonomy-aligned, starting from the 2022 financial year for many large companies.

EU Taxonomy, CSRD and SFDR

The EU Taxonomy serves as the foundational classification system for environmentally sustainable economic activities within the EU’s broader sustainable finance framework.

It is directly integrated into major reporting regulations such as the Corporate Sustainability Reporting Directive (CSRD) and the Sustainable Finance Disclosure Regulation (SFDR), ensuring that sustainability disclosures across companies and financial products are consistent and comparable.

CSRD

The CSRD requires companies to report how much of their turnover, capital expenditures (CapEx), and operating expenditures (OpEx) are aligned with the EU Taxonomy’s criteria for sustainability. This means that the Taxonomy’s definitions and metrics are embedded within the CSRD’s mandatory sustainability reporting, making it a core part of how companies communicate their environmental performance.

SFDR

Financial institutions subject to the SFDR must disclose the extent to which their investment products are invested in Taxonomy-aligned activities. To do this, they rely on the Taxonomy-based disclosures made by companies under the CSRD, creating a data flow and alignment between corporate and financial sector reporting.

A digital solution for EU Taxonomy

MasterSustainability.today is a complete ESG suite for full compliance and maximum impact. Explore our modules or schedule a call with one of our experts to see if we can help you explore how your business can comply with EU Taxonomy.

Features of our EU Taxonomy module

Each of the topics below has got its own module including multiple features per module:

- Taxonomy eligibility

- Technical screening

- Objectives and initiatives

- Data calculations and AI

- Reports and disclosures

Explore one of our other modules for a tailored ESG solution

CSRD - ESRS

CSRD reporting made easy: digital materiality assessments, streamlined data management, and audit ready in three months.

VSME - ESRS

Effortless adopt VSME for sustainability reporting. Go for basic or comprehensive and use sustainability reporting as a strategic advantage.

CSDDD

Streamline the entire due diligence process—from mapping supply chains and assessing risks to tracking corrective actions and generating reports.

Carbon Accounting

Use our carbon management module to measure and reduce CO2 emissions. Easily integrated with existing tech stack and existing regulations.

CBAM

Prepare for upcoming Carbon Border Adjustment regulations. Address regulatory requirements with accuracy with a complete ESG platform.

EUDR - Deforestation

From risk assessment to due dilligence and reporting. We've got you covered. Our platform simplifies the process so you can make an impact.

Speak to an expert

Fill in the form and we will contact you to make an online or offline appointment. During this appointment we will go through your challenges and show you the possibilities of our software.